Best Credit Counselling Singapore: Click Here for Dependable Support

The Value of Credit History Therapy: A Comprehensive Overview to Improving Your Financial Wellness

Credit counselling offers as a crucial resource for people looking for to boost their economic health and wellness, offering customized techniques and insights that deal with particular financial obstacles. By promoting a deeper understanding of budgeting, financial obligation monitoring, and lender settlement, credit scores counsellors empower customers to browse their monetary landscape with better confidence.

Comprehending Credit Score Counselling

Credit history coaching works as an essential resource for people facing financial obligation monitoring and financial literacy. It includes a process where educated specialists provide assistance and education and learning to help customers recognize their financial scenarios, establish budget plans, and create plans to handle financial obligation properly. Credit rating counsellors evaluate an individual's financial health by analyzing earnings, expenses, and existing financial obligations.

The main goal of credit history counselling is to empower people with the expertise and skills essential to make educated financial choices. This usually consists of informing clients concerning credit history, rate of interest rates, and the effects of various sorts of financial obligation. Furthermore, debt therapy can promote interaction between clients and financial institutions, potentially leading to much more favorable settlement terms.

It is necessary to recognize that credit history counselling is not a one-size-fits-all remedy; the technique can vary significantly based on specific situations and needs. Customers are encouraged to involve proactively while doing so, as their involvement is crucial for accomplishing long-lasting financial stability. By cultivating an understanding of responsible practices and economic principles, credit rating therapy lays the foundation for a healthier monetary future.

Advantages of Debt Coaching

Among one of the most substantial benefits of credit score therapy is the customized assistance it offers to individuals dealing with economic difficulties. This customized method makes certain that customers obtain advice specific to their distinct financial situations, enabling them to make informed choices concerning their expenses and financial debts. Credit scores counsellors analyze customers' economic health, assisting them recognize underlying problems and create actionable strategies to improve their conditions.

In addition, credit report therapy supplies education and learning on effective budgeting and money management strategies. Clients get important insights right into their spending routines, encouraging them to make smarter monetary choices moving on. This academic element not just help in immediate financial debt resolution but also cultivates lasting financial proficiency.

One more key benefit is the capacity for discussing with lenders. Credit history counsellors frequently have developed connections with financial institutions, allowing them to support in support of their clients for lower passion prices or more convenient settlement terms. This can result in considerable savings gradually.

Inevitably, credit history counselling can alleviate the emotional stress related to economic difficulties. By equipping individuals with the tools and sources they need, it promotes a feeling of empowerment, helping them restore control over their financial futures.

Exactly How Credit Rating Therapy Works

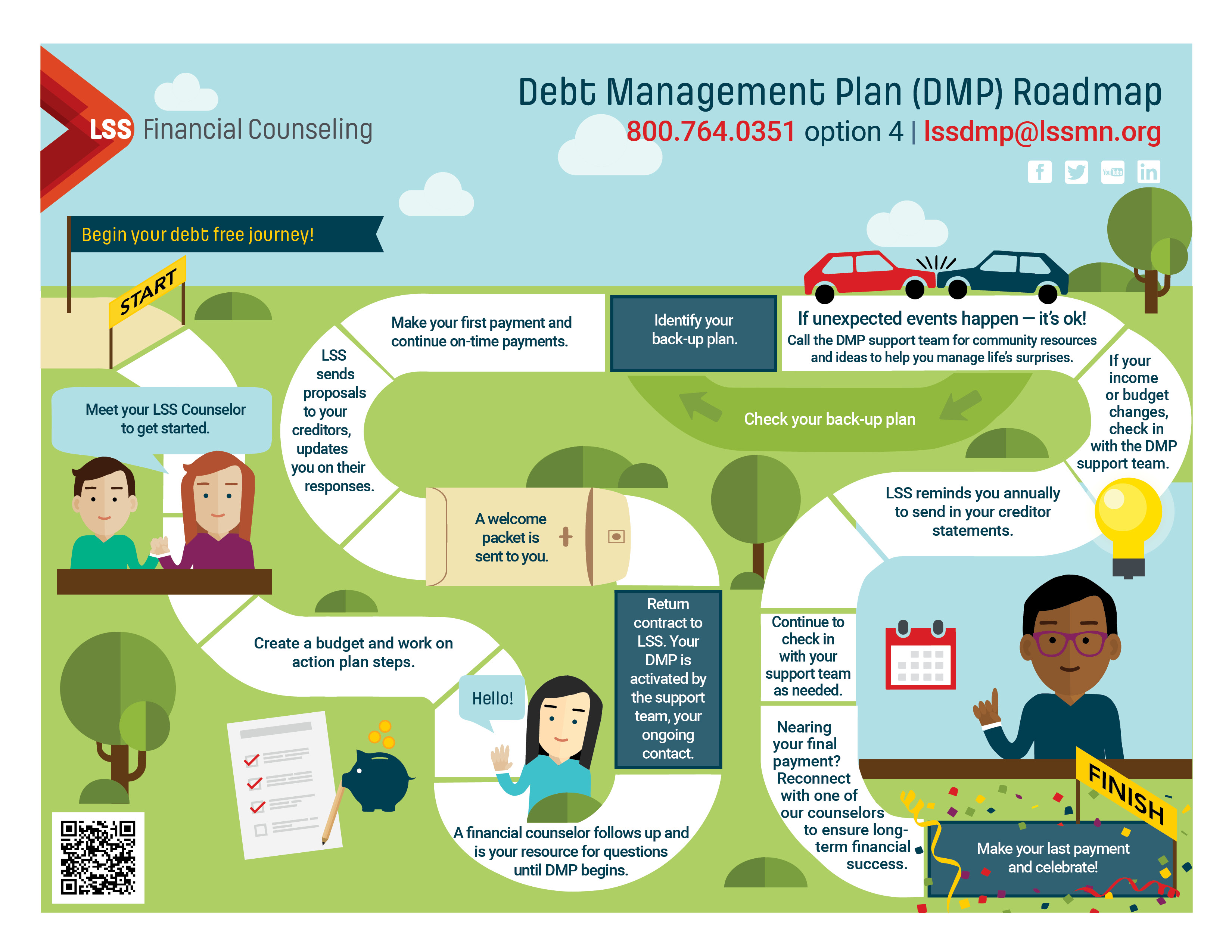

Involving with a debt coaching solution commonly begins with a first consultation, where a qualified credit counsellor assesses the customer's monetary scenario. During this analysis, the counsellor collects detailed info concerning revenue, expenditures, debts, and overall financial routines. This detailed understanding allows the counsellor to identify the underlying problems contributing to economic distress.

Following the evaluation, the counsellor functions collaboratively with the customer to develop a tailored activity plan focused on boosting economic wellness. This plan might consist of budgeting techniques, financial obligation management strategies, and recommendations for credit scores restoring. The counsellor supplies assistance on prioritizing financial obligations, working out with creditors, and exploring possible solutions such as financial debt administration programs or economic education resources.

Customers are motivated to proactively participate in the procedure, fostering responsibility and dedication to the agreed-upon approaches. Routine follow-ups are frequently set up to analyze development and make required changes to the plan. Inevitably, credit scores counselling works as an essential resource, equipping clients to reclaim control of their funds, boost their creditworthiness, and attain long-term monetary stability.

Choosing the Right Debt Counsellor

Picking an appropriate credit rating counsellor is a vital step in resolving monetary challenges successfully. The right counsellor can offer important understandings, assistance, and customized techniques to assist you gain back control of your economic circumstance - credit counselling services with EDUdebt. When picking a credit scores counsellor, consider their qualifications and experience. Seek certified specialists connected with trustworthy companies, as this suggests a commitment to moral practices and recurring education and learning.

Furthermore, examine their solutions and approach. Some counsellors use comprehensive monetary education, while others concentrate on particular problems like financial obligation monitoring or budgeting. It's essential to find a counsellor who aligns with your certain demands and comfort level.

Expense is another important variable. Several charitable credit coaching agencies provide services at little to no charge, while others might bill fees. Always inquire about these charges upfront to avoid unanticipated expenses.

In addition, trust fund your instincts; a great relationship with your counsellor can enhance the efficiency of your sessions. Take into consideration looking for recommendations from friends or family that have had favorable experiences with debt counselling. Inevitably, making the effort to choose the right credit history counsellor can lead to meaningful renovations in your economic wellness.

Actions to Enhance Your Financial Health

Following, produce a reasonable spending plan that aligns with your monetary goals. Focus on vital expenditures while determining discretionary investing that can be minimized. Executing a budgeting tool or application can improve monitoring and liability.

Financial obligation monitoring is check it out one more vital component. credit counselling services with EDUdebt. Consider combining high-interest financial obligations or working out with lenders for far better terms. Establish a payment strategy that permits for regular payments, decreasing general financial obligation worry in time

Developing a reserve need to also be a priority. Goal to conserve at the very least three to 6 months' well worth of living expenses to support versus unanticipated economic setbacks.

Final Thought

Involving with a professional credit rating counsellor not just lowers monetary stress however also fosters responsibility, ultimately adding to an extra safe and secure and secure economic future. The significance of credit history therapy can not be overstated in the search of monetary wellness.

Involving with a credit scores coaching service normally starts with an initial assessment, where a trained credit rating counsellor examines the customer's economic scenario. Ultimately, my company credit score counselling serves as a critical resource, empowering customers to reclaim control of their finances, enhance their creditworthiness, and accomplish long-term monetary stability.