Little Known Facts About Custom Private Equity Asset Managers.

Some Known Details About Custom Private Equity Asset Managers

(PE): spending in firms that are not openly traded. About $11 (https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1701758819&direction=prev&page=last#lastPostAnchor). There might be a couple of points you do not comprehend concerning the market.

Exclusive equity companies have a variety of investment preferences.

Because the most effective gravitate towards the bigger offers, the middle market is a considerably underserved market. There are much more sellers than there are very skilled and well-positioned financing professionals with comprehensive purchaser networks and resources to manage a bargain. The returns of private equity are usually seen after a few years.

Indicators on Custom Private Equity Asset Managers You Should Know

Flying below the radar of large international firms, most of these tiny firms frequently provide higher-quality customer care and/or specific niche products and find here services that are not being provided by the large empires (https://www.storeboard.com/customprivateequityassetmanagers). Such advantages draw in the rate of interest of private equity companies, as they possess the understandings and smart to exploit such possibilities and take the business to the next degree

A lot of supervisors at portfolio firms are given equity and reward settlement structures that award them for striking their monetary targets. Exclusive equity opportunities are often out of reach for people that can not invest millions of bucks, however they shouldn't be.

There are policies, such as limits on the accumulation quantity of money and on the number of non-accredited financiers (Private Investment Opportunities).

About Custom Private Equity Asset Managers

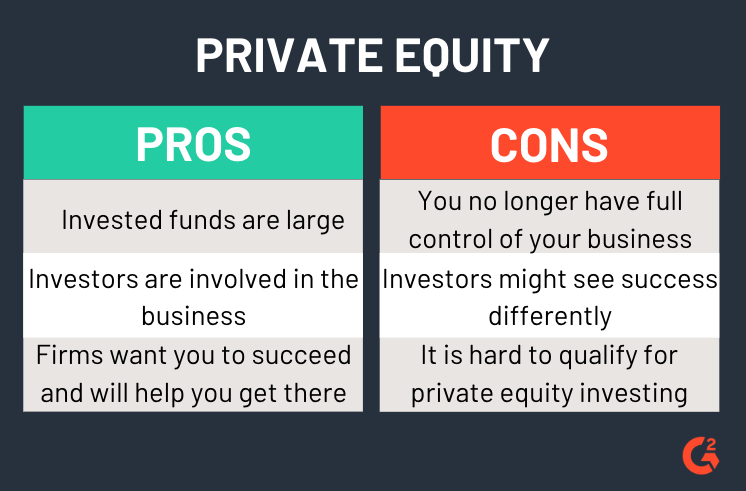

Another disadvantage is the absence of liquidity; once in an exclusive equity deal, it is difficult to obtain out of or sell. There is an absence of versatility. Private equity additionally comes with high costs. With funds under monitoring currently in the trillions, private equity companies have come to be attractive financial investment automobiles for rich people and organizations.

Now that accessibility to private equity is opening up to more individual financiers, the untapped potential is becoming a reality. We'll start with the main disagreements for investing in personal equity: Exactly how and why personal equity returns have actually historically been higher than other assets on a number of levels, Just how consisting of personal equity in a portfolio affects the risk-return profile, by aiding to expand versus market and cyclical risk, After that, we will certainly detail some essential considerations and risks for private equity capitalists.

When it pertains to presenting a brand-new possession into a profile, one of the most fundamental consideration is the risk-return account of that property. Historically, personal equity has actually shown returns similar to that of Emerging Market Equities and more than all various other standard asset courses. Its fairly reduced volatility combined with its high returns produces a compelling risk-return profile.

Some Known Facts About Custom Private Equity Asset Managers.

Exclusive equity fund quartiles have the widest array of returns across all alternate property classes - as you can see below. Methodology: Interior price of return (IRR) spreads out determined for funds within classic years separately and afterwards balanced out. Mean IRR was calculated bytaking the average of the mean IRR for funds within each vintage year.

The impact of adding personal equity into a portfolio is - as constantly - dependent on the profile itself. A Pantheon study from 2015 recommended that including personal equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the most effective private equity companies have access to an even larger swimming pool of unknown chances that do not face the same scrutiny, in addition to the sources to execute due persistance on them and identify which are worth investing in (Asset Management Group in Texas). Investing at the very beginning indicates greater danger, however, for the business that do succeed, the fund gain from higher returns

The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

Both public and private equity fund managers dedicate to investing a percentage of the fund however there continues to be a well-trodden problem with aligning passions for public equity fund administration: the 'principal-agent problem'. When an investor (the 'major') hires a public fund supervisor to take control of their funding (as an 'agent') they hand over control to the supervisor while keeping ownership of the properties.

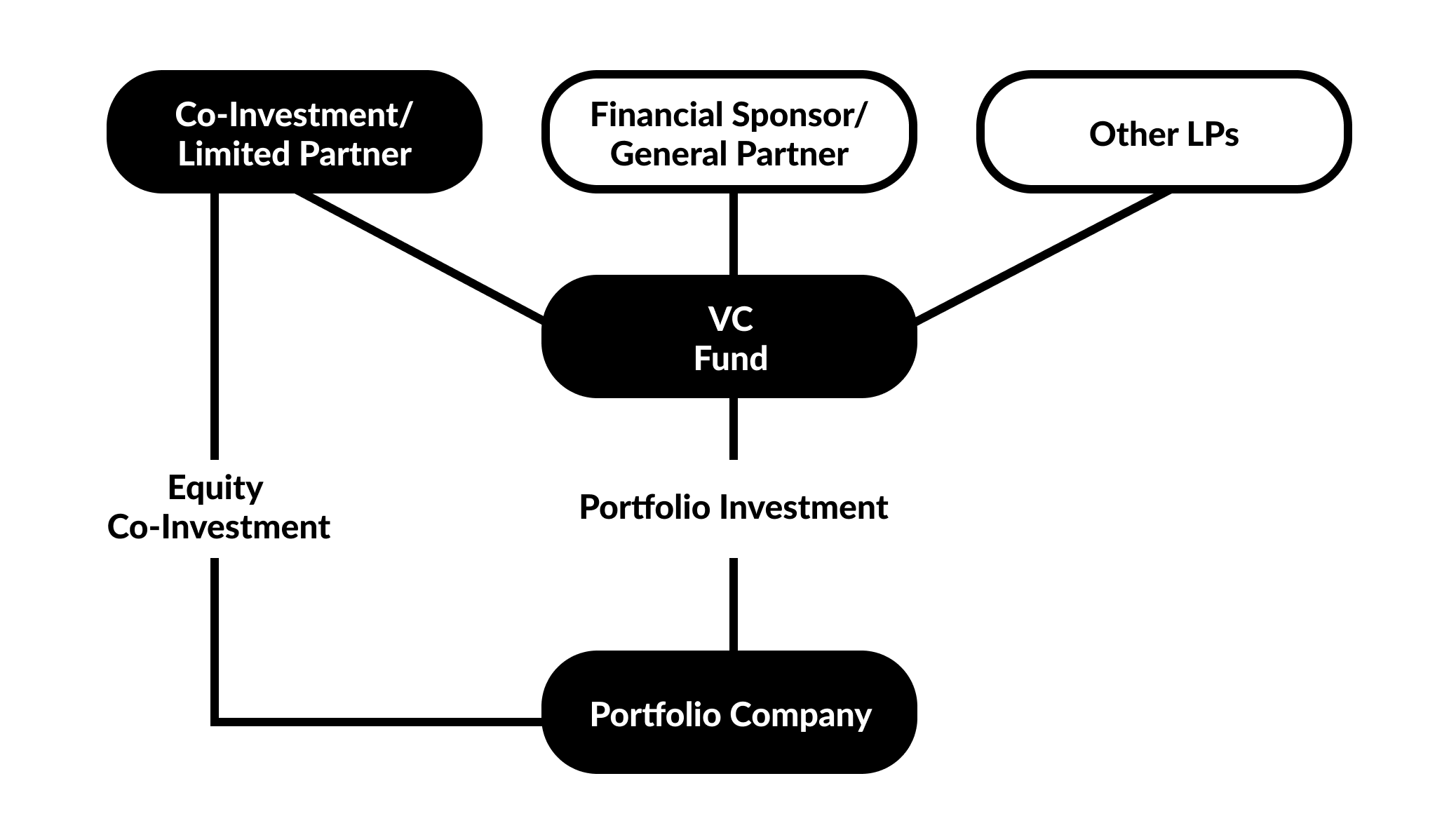

In the case of private equity, the General Companion doesn't simply gain a management fee. Personal equity funds likewise reduce an additional type of principal-agent issue.

A public equity capitalist inevitably desires one thing - for the administration to raise the supply price and/or pay dividends. The capitalist has little to no control over the choice. We revealed above the number of private equity methods - especially bulk acquistions - take control of the running of the business, making sure that the long-term value of the firm precedes, pressing up the roi over the life of the fund.